- Trump grows irate at Apple's move into India.

- President claims Apple must produce US-sold iPhone in US or face a 25% tariff.

- US equity futures slip more than 1% in Friday premarket after Trump threatens the EU with a 50% tariff.

- Apple stock gives up 4% in the premarket on Friday.

Apple (AAPL) stock is back in US President Donald Trump's crosshairs on Friday as America's 47th president lambasted the Mac-maker for investing in production capacity in India rather than the United States.

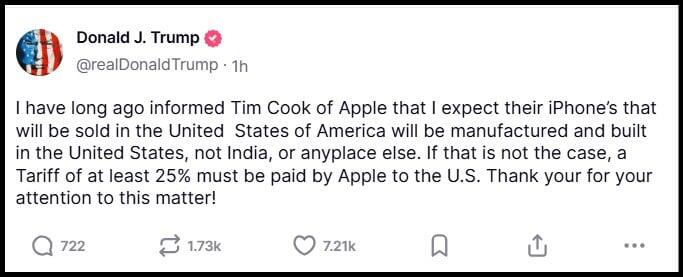

In a post on Truth Social, Trump wrote:

“I have long ago informed [CEO] Tim Cook of Apple that I expect their iPhone’s [sic] that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else. If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S."

Apple shares sold off some 4% in the premarket on the news. The market figured that Apple was in the clear after the company was able to garner an exemption for its iPhone last month while it moved production from China to India. The company also used private planes to import iPhones itself rather than rely on slower transportation methods.

Apple also announced $500 billion of investment in the US after Trump came into office, something that many thought would soothe Trump's temper.

Politico reported that Cook had an Oval Office meeting with Trump on Tuesday, but both the White House and the company failed to disclose what was discussed.

Trump admitted to reporters on his recent trip to the Middle East last week that he was annoyed by Apple. He told reporters that he “had a little problem with Tim Cook.”

Post from May 23, 2025 on Truth Social

But that wasn't the end of Trump's Friday morning tirade. He then singled out the European Union (EU). Claiming that the monetary union was created to take advantage of the United States, Trump posted that the EU's "Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more" had led to a $235 million trade deficit with the US. In terms of trade, this figure is quite small, and Trump surely meant "billion" instead of "million". The US trade deficit for physical goods with the EU in 2024 was $235.6 billion, according to the Office of the United States Trade Representative.

Trump then said he would be "recommending" a 50% tariff on the EU starting June 1, nine days from now.

Apple stock forecast

Apple stock is now trading beneath the $196 support level that stems from resistance and support during the June to August stretch of 2024. The nearest bit of support comes from the May 7 low at $193.25.

Other levels of support, owing to 2024, come in at $180 and $164. The April 8 plunge arrived in between those levels and just below $170.

AAPL trades below its 50-day and 200-day Simple Moving Averages (SMA), so another move lower is definitely at better than even odds. Dow, S&P 500 and NASDAQ futures are all down between 1.1% and 1.7% in the premarket at the time of writing, so expect bearish sentiment to lead to intraday lows below Apple's premarket levels.

AAPL daily stock chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows, back near 1.1330

EUR/USD meets daily support around the 1.1300 neighbourhood, managing to regain pace and revisit the 1.1330 region. Sentiment turned after President Trump proposed a “straight 50% tariff” on European imports, undermining the pair’s bullish momentum.

GBP/USD eases from tops, revisits the 1.3500 zone

GBP/USD benefits from broad US Dollar weakness, climbing to its highest level since February 2022 past 1.3500 at the end of the week. UK retail sales data surprised to the upside in April, lending extra wings to the quid.

Gold keeps the bullish tone near $3,350

Gold extends its weekly advance, trading around $3,350 per troy ounce on Friday. The rally in XAU/USD is driven by broad-based weakness in the Greenback, particulalry after President Trump’s threat to impose 50% tariffs on European imports.

Apple stock sinks below $200 after Trump threatens more tariffs Premium

Trump grows irate at Apple's move into India. President claims Apple must produce US-sold iPhone in US or face a 25% tariff. US equity futures slip more than 1% in Friday premarket after Trump threatens the EU with a 50% tariff.

Ripple Price Prediction: Whale accumulation sparks hope as rising exchange reserves signal caution

XRP sustains mid-week recovery as XRP/BTC flashes golden cross for the first time since 2017. Large volume holders increase XRP exposure, indicating rising demand and investor confidence.