- The US state of Florida has indefinitely postponed and withdrawn two crypto bills to form the Strategic Bitcoin Reserve from consideration.

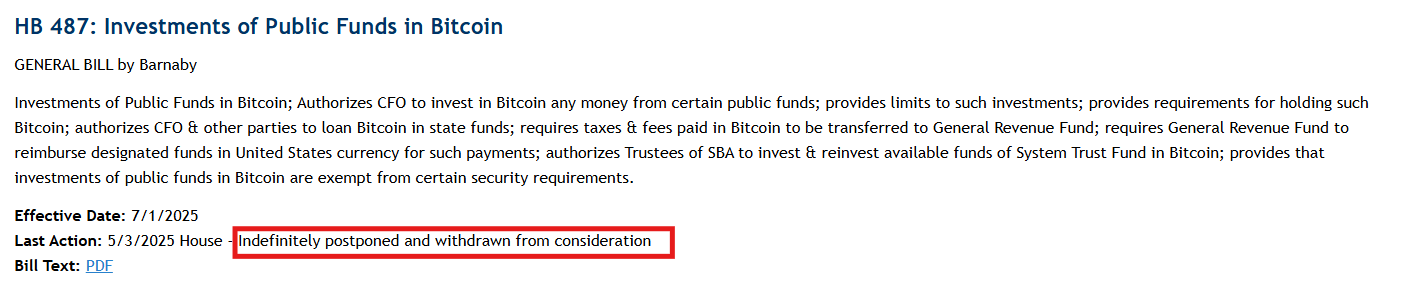

- The two bills, HB 487 and SB 550, which aim to allocate up to 10% of public funds to BTC, were closed on Saturday.

- Meanwhile, the Arizona bill remains in the race, awaiting the governor’s approval.

The US state of Florida has indefinitely postponed and withdrawn two crypto bills to form the Strategic Bitcoin Reserve from consideration. The two bills, House Bill 487 (HB 487) and Senate Bill 550 (SB 550), which aim to allocate up to 10% of public funds to BTC, were closed on Saturday. Meanwhile, the Arizona bill remains in the race, awaiting the governor’s approval.

Florida joins other states in failing to pass bills for the Strategic Bitcoin Reserve

The Florida Senate announced on Saturday that two crypto bills for establishing a Strategic Bitcoin Reserve were indefinitely postponed and withdrawn from consideration. HB 487 and SB 550, which aim to allocate up to 10% of public funds to BTC, were officially pulled.

This marks a setback for crypto adoption in the US states, as Florida, along with Wyoming, South Dakota, North Dakota, Pennsylvania, Montana and Oklahoma, have all seen Bitcoin bills fail to pass House or Senate votes, according to Bitcoin Laws.

What about Arizona Bitcoin reserve plans?

In Arizona’s case, bill SB 1025 was passed on April 28. It allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin.

However, Governor Katie Hobbs vetoed the bill on Friday for being an “untested investment,” despite Arizona’s House and Senate approval.

Arizona Senator Wendy Rogers, who introduced the bill to the House, said in her X post, “I will refile my bill next session.”

Rogers continued: “I understand the governor vetoed my Arizona Bitcoin Reserve Bill. That is unfortunate. Politicians don’t understand that Bitcoin doesn’t need Arizona. Arizona needs Bitcoin.”

I understand the governor vetoed my Arizona Bitcoin Reserve Bill. That is unfortunate. Politicians don’t understand that Bitcoin doesn’t need Arizona. Arizona needs Bitcoin. I will refile my bill next session. If she vetoes it again, I am sure Governor Andy Biggs will be happy to… pic.twitter.com/cUEqvfvCY9

— Wendy Rogers (@WendyRogersAZ) May 3, 2025

“Arizona has two more chances to be the first in the nation to establish a Bitcoin Reserve,” said Satoshi Action Fund CEO & co-founder Dennis Porter on Monday.

He explained further that HB 2749 is most likely to pass. It offers a budget-neutral method of funding the reserve using profit from the unclaimed property fund.

Arizona has two more chances to be the first in the nation to establish a Bitcoin Reserve.

— Dennis Porter (@Dennis_Porter_) May 5, 2025

The most likely to pass (HB 2749) was authored by @JeffWeninger, and it offers a budget neutral method to fund the reserve using profit from the unclaimed property fund. @EleanorTerrett pic.twitter.com/yGlrz2saql

If these bills receive a green light, Arizona would be the first state to require public funds to invest in Bitcoin. Arizona would also become the first US state to hold Bitcoin as a reserve asset, which could set a precedent for other states, such as New Hampshire, North Carolina and Texas, also listed in the State Reserve Race.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple Price Prediction: Whale accumulation sparks hope as rising exchange reserves signal caution

XRP sustains mid-week recovery as XRP/BTC flashes golden cross for the first time since 2017. Large volume holders increase XRP exposure, indicating rising demand and investor confidence.

Pi Network Price Forecast: PI eyes $0.66 as whale activity surges

Pi Network (PI) declines by nearly 4% on Friday, trading at $0.79 at press time. The technical outlook suggests a downward move ahead as the short-term recovery concludes with a trendline breakdown.

Bitcoin Weekly Forecast: BTC enters full price-discovery mode after seven straight weeks of gains

Bitcoin price stabilizes around $111,000 on Friday after reaching a new all-time high of $111,900 this week. Corporate accumulation, institutional demand, signs of easing regulations and fiscal woes in the US have fueled BTC’s rally.

Jupiter Price Forecast: JUP eyes $0.82 as Fluid backs Jupiter's upcoming lending protocol

Jupiter exchanges announced the upcoming launch of Jupiter Lend, powered by Fluid, on Solana this summer. With the announcement of Jupiter Lend, the JUP token surged 16% in the last 24 hours.

Bitcoin: BTC enters full price-discovery mode after seven straight weeks of gains

Bitcoin (BTC) price stabilizes near $111,000 on Friday after reaching a new all-time high of $111,900 this week. BTC enters an uncharted territory as a perfect storm of corporate accumulation, institutional demand, signs of easing regulation and increasing concerns among investors about debt sustainability in the United States (US) have fueled bullish momentum.