- TRX price holds firm above weekly support at $0.244, with a potential upside target of $0.260.

- Tron’s DEX trading volume reaches a new yearly high of over $750 million, signaling increased user activity and liquidity.

- Stablecoin market capitalization on Tron nears $72 billion, indicating sustained demand and growing ecosystem trust.

Tron (TRX) price holds firm above its support level, trading around $0.247 at the time of writing on Tuesday, with a potential upside target of $0.260 if the support level continues to hold. Tron’s decentralized exchange (DEX) trading volume reaches a yearly high of over $750 million, signaling increased user activity and liquidity. Stablecoin market capitalization on Tron nears $72 billion, indicating sustained demand and growing ecosystem trust.

Tron shows positive bias as DEX volume surges, stablecoin demand grows

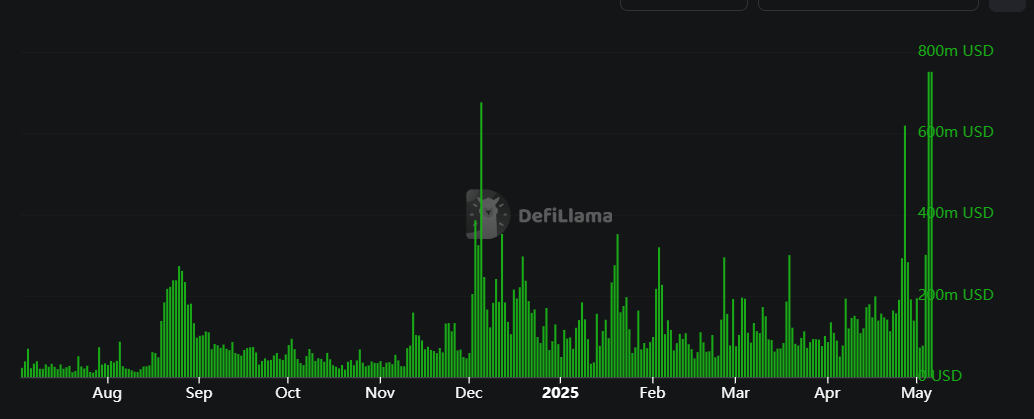

Crypto intelligence tracker DefiLlama data shows that on Tuesday, the TRX chain decentralized exchange (DEX) trading volume rose to a new year-to-date high of $751.08 million. This volume signaled increased user activity and liquidity in the TRX blockchain, boosting its bullish outlook.

TRX DEX trading volume chart. Source: DefiLlama

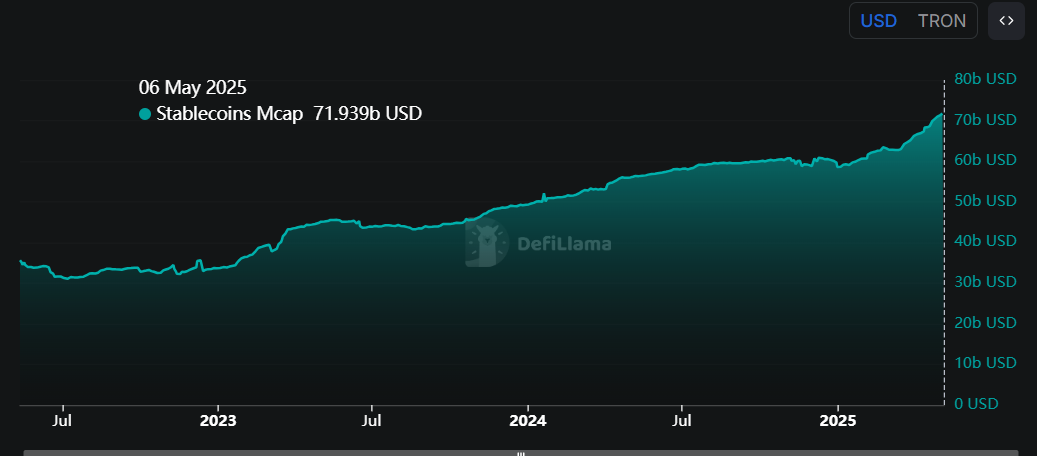

Additionally, the value of stablecoins on the Tron blockchain has steadily risen since mid-March. According to DefiLlama data, the stablecoin market capitalization currently stands at $71.93 billion, a new all-time high (ATH). Such stablecoin activity and value increase on the TRX project indicate a bullish outlook, as it indicates sustained demand and growing ecosystem trust, which can attract more users to the ecosystem, driven by Decentralized Finance (DeFi), meme coins, and payment use cases.

TRX stablecoin Mcap chart. Source: DefiLlama

Tron Price Forecast: TRX bulls could target $0.26 if weekly support remains strong

Since last week, the Tron price has been consolidating around its weekly support level of $0.244. At the time of writing on Tuesday, it trades slightly down at around $0.247.

If the weekly level at $0.244 holds and TRX rallies above it, it could extend the gains and retest its April 14 high of $0.259.

The Relative Strength Index (RSI) hovers around its neutral level of 50, indicating indecisiveness among traders. For the bullish momentum to be sustained, the RSI must move above 60 for a rally ahead. Moreover, the Moving Average Convergence Divergence indicator also coils against each other, indicating indecisiveness among TRX investors. The MACD should show a bullish crossover for an uptrend ahead.

TRX/USDT daily chart

However, if TRX closes below the weekly level of $0.244, it could extend the decline to retest its April 11 low of $0.234.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple risks extending losses despite Ripple-SEC motion to release escrowed $125 million

XRP comes under immense pressure, falling toward $2.09 as Israel and Iran escalate conflict. Ripple and the SEC file a joint motion requesting the release of $125 million held in escrow.

Crypto Today: Bitcoin, Ethereum, XRP clamber for support amid escalating volatility on Israel-Iran tensions

The cryptocurrency market has been hit by a sudden wave of extreme volatility, triggering widespread declines as global markets react to tensions between Israel and Iran.

Sui Price Forecast: Sui eyes triangle fallout below $3 as Open Interest, TVL plunge

Sui (SUI) edges lower by over 5% at press time on Friday, concurrent with the broader crypto market crash due to the escalation of the conflict between Israel and Iran.

Bitcoin eyes a drop toward $100,000 amid cautious sentiment as Middle East tensions escalate

Bitcoin price edges below $105,000 on Friday after falling 4% over the last two days. Market sentiment sours as conflict in the Middle East escalates, with over $1.15 billion in liquidation across crypto markets.

Bitcoin: BTC could slump to $100K amid Trump-Musk tussle

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility in the market. The effect of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla's stock price on Thursday, although both are recovering on Friday.