- Hyperliquid resumes gains after three days of losses, targeting $40.00 after rebounding from $35.00 support.

- HYPE's DeFi TVL reached an average of $1.77 billion on Friday, marking an 80% increase over the past three months.

- Hyperliquid is on the verge of a technical breakout, targeting 24% increase to its all-time high.

Hyperliquid (HYPE) breaks a streak of three consecutive days of losses on Friday, up almost 3% to trade at around $36.82 at the time of writing. The high-performance Layer-1 blockchain token is attempting a trend reversal, following a 23% decline from its all-time high of $45.71 reached on June 16. Support tested at $35.34 has paved the way for the current push toward the critical resistance at $40.00 and, potentially, the all-time high.

Hyperliquid DeFi TVL growth signals investor confidence

Interest in Hyperliquid has steadily increased over the past three months, buoyed by the HYPE's price rally to all-time highs. According to DeFiLlama, the Decentralized Finance (DeFi) Total Value Locked (TVL), which represents the total value of all coins held in smart contracts linked to protocols on the chain, stood at around $1.77 billion on Friday.

The uptrend over the past three months, since April 1, has led to an 80% increase in the TVL from approximately $353 million. This suggests that user confidence and trust in the token and the ecosystem are growing, evidenced by the surge in deposits and staking.

Hyperliquid DeFi TVL data | Source: DeFiLlama

A higher TVL figure reflects adequate liquidity in the protocol's DeFi platforms, encompassing lending, borrowing, and trading. In general, Hyperliquid boasts a positive sentiment backed by token holders and platform adoption.

At the same time, a higher TVL volume predisposes HYPE to price increases amid reduced sell-side pressure because users lock their holdings in smart contracts.

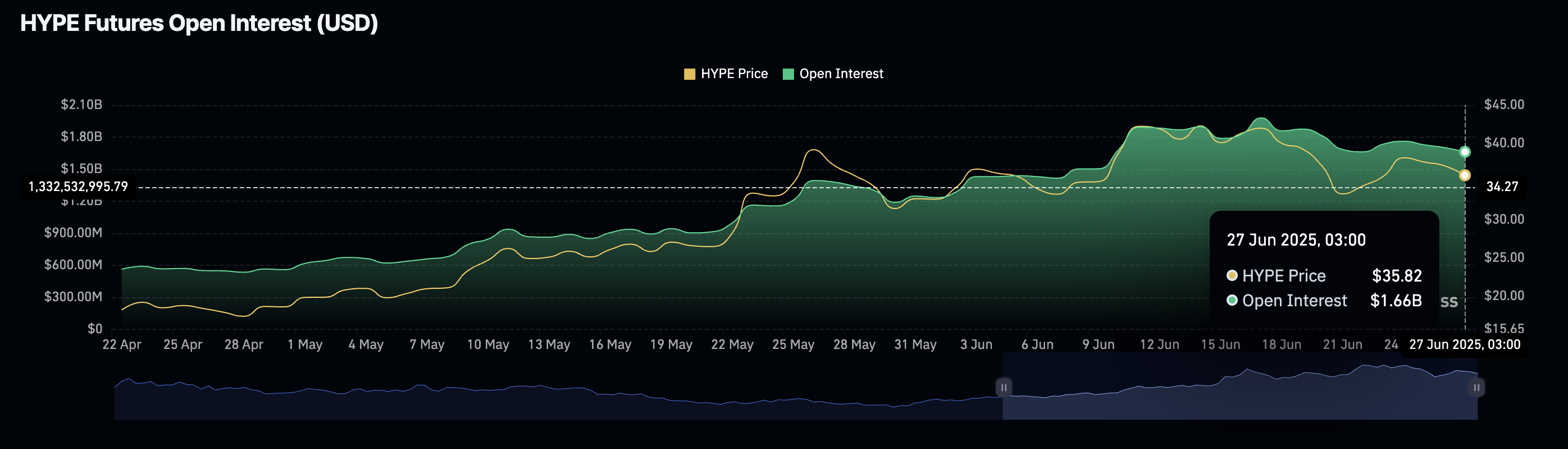

However, investors may need to temper their expectations based on the downward trend in HYPE futures contracts' Open Interest (OI). CoinGlass data shows that OI averaged $1.66 billion on Friday after peaking at around $1.98 billion on June 17.

Open Interest refers to the US Dollar (USD) of all futures and options contracts that have yet to be settled or closed. A persistent decline indicates that traders are losing interest in HYPE and are unlikely to be betting on price increases in the short term.

Hyperliquid Open Interest data | Source: CoinGlass

If volume drops in tandem, trading activity will slow down, possibly limiting bullish momentum and leaving Hyperliquid vulnerable to a decline.

Technical outlook: Hyperliquid attempts recovery, but bearish signals persist

Hyperliquid's price is printing a green candle on Friday after securing technical support at around $35.34. A breakout toward the $40.00 key hurdle will likely follow if bulls rise above a confluence resistance at around $37.14, where the 100-period Exponential Moving Average (EMA) and the 50-period EMA converge with the upper boundary of the descending channel on the 4-hour chart.

The Relative Strength Index (RSI) hovers slightly above the midline, indicating mild bullish momentum. Traders should monitor the market for continued movement toward overbought territory to assess the strength of the uptrend.

HYPE/USD 4-hour chart

Still, the Moving Average Convergence Divergence (MACD) indicator sustains a sell signal that was flashed on Thursday, which could dilute bullish momentum.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Sui’s $120 million linear token unlock risks 15% decline as market sentiment slows

Sui continues to extend its losses from June, trading at around $2.71 on Tuesday. The high-performance layer-1 blockchain token has experienced a 15.5% decline over the last 30 days, reflecting subdued market sentiment amid geopolitical tensions and macroeconomic uncertainty.

Crypto Today: Bitcoin, Ethereum, XRP edge slightly lower amid low retail interest

Bitcoin edges down for a second consecutive day, with the price dancing between the round-figure support at $100,000 and resistance slightly below all-time highs of $111,980. Interest in Bitcoin has continued to drop, signaling a lack of confidence particularly among retail investors.

Bitcoin Cash Price Forecast: Bullish momentum holds as BCH eyes potential channel breakout

Bitcoin Cash (BCH) ticks higher by over 3% at press time on Tuesday, marking a bullish start to July. A spike in BCH Open Interest supports the bullish technical outlook, suggesting a potential breakout from a rising channel pattern.

Tron Price Forecast: SRM Entertainment stakes 365 million TRX tokens as part of its TRON treasury plan

Tron price hovers around $0.279 on Tuesday after rallying 5% the previous week. SRM Entertainment completes its $100 million TRON treasury launch, staking 365 million TRX tokens.

Bitcoin: Inches away from all-time highs

Bitcoin price recovers nearly 7% so far this week, remaining just inches away from its record levels. Global risk appetite is increasing as the ceasefire between Iran and Israel, along with the Fed's softer stance on crypto-related banking, takes hold.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.