- EOS slides on Monday, extending losses toward the 50-day EMA short-term support.

- EOS’s rebranded Vaulta’s DeFi TVL volume reached $273 million on Saturday before correcting to $246 million.

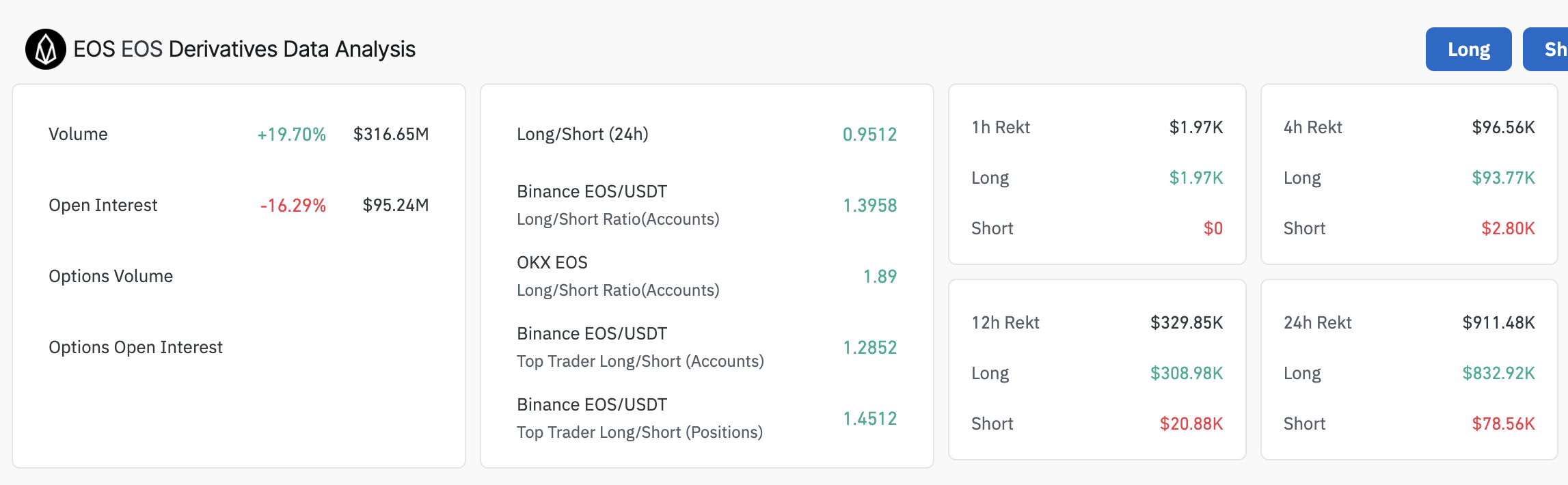

- A 16% drop in the derivatives Open Interest to $95M, with rising long position liquidations signaling fading trader interest.

EOS price slides on Monday to approximately $0.75, erasing a minor uptick on Sunday, while extending the drawdown from the May 10 high at around $0.99. The EOS network rebranded to Vaulta in the first quarter, paving the way for a web3 banking platform. Investors and cryptocurrency exchanges are preparing for the token swap from EOS to Vaulta (A), which is expected to start on May 26.

The token swap from EOS to Vaulta aims to align the asset with its new web3 banking vision.

Vaulta’s DeFi TVL surges ahead of EOS token swap

The Total Value Locked (TVL) in Vaulta’s Decentralized Finance (DeFi) ecosystem has experienced tremendous growth since early March, peaking at approximately $273 million on Saturday, up from nearly $100 million recorded on March 1.

This surge highlights increased user activity, staking, and liquidity provision, encouraging investors to lock assets in Vaulta’s DeFi protocols.

Investors often prefer to stake their assets in smart contracts, engage in lending, borrowing, and yield farming protocols when they are confident in the ecosystem’s long-term value and the potential for price appreciation.

Vaulta’s DeFI TVL | DefiLlama

A minor drop to $246 million from the weekend high of $273 million underscores the headwinds and changing dynamics in the broader cryptocurrency market.

CoinGlass derivatives data shows a significant 16% slump in Open Interest (OI) to roughly $95 million, reflecting declining trader interest. OI is the total number of active outstanding futures or options contracts that have not been closed or settled.

Declining OI as trading volume increases by nearly 20% to $316 million implies that more traders are generally closing positions instead of opening new ones. This could indicate potential profit-taking or even the unwinding of positions.

EOS derivatives market data | CoinGlass

There were more long position liquidations in the last 24 hours, with around $833,000 wiped out compared to approximately $79,000 in shorts. Increase in long position liquidations as OI drops hints at a potential downtrend and heightened volatility as fewer traders make bullish bets.

EOS retreats, seeking stability above short-term support

EOS’s price correction from the MAy 10 high, slightly below $1.00, seeks support above the 50-day Exponential Moving Average (EMA) at approximately $0.73.

Bears are gaining control, as the Relative Strength Index (RSI) trends downward, falling below the 50 midline after peaking at 76.11 on May 10.

The current technical outlook signals weakening bullish momentum, accentuated by the Money Flow Index (MFI) falling sharply to 57.74 from an overbought peak of around 82.93.

Note that the MFI tracks the flow of money in and out of EOS, with persistent drawdowns likely to trigger an extended downtrend in the price of EOS.

EOS/USDT daily chart

The 50-day EMA offers immediate support at $0.73, which could absorb the potential selling pressure. Marginally below this level, the 100-day and the 200-day EMAs are in line to provide additional support at $0.70 and $0.69, respectively, against heightened selling.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink Price Forecast: LINK rebounds as Real-World utility and bullish bets surge

Chainlink trades around $14.57 on Tuesday after rebounding from its key support level the previous week. Chainlink is facilitating the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin. LINK’s bullish bets among traders have reached the highest level in over a month.

Circle stock extends rally following T-Rex, ProShares and Bitwise filings for ETFs based on CRCL

Circle jumped 7% on Monday following filings of asset managers T-Rex, ProShares and Bitwise to launch separate exchange-traded funds tracking Circle's CRCL stock, less than a week after it went live on the New York Stock Exchange.

Bitcoin spikes above $110K after account of Paraguay's president claims BTC legal tender

Bitcoin rose 4% following a post from Paraguayan President Santiago Peña's hacked X account stating that BTC has been approved as a legal tender in the country. The post was deleted after Presidencia Paraguay flagged the information as false.

Ripple Price Prediction: XRP bullish as Ripple advances Web3 and DeFi in Japan

Ripple pared losses following last week's sell-off to trade at around $2.26 at the time of writing on Monday. The sideways trading comes ahead of trade negotiations between the United States and China in London, which could catalyse recovery in global markets.

Bitcoin: BTC could slump to $100K amid Trump-Musk tussle

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility in the market. The effect of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla's stock price on Thursday, although both are recovering on Friday.